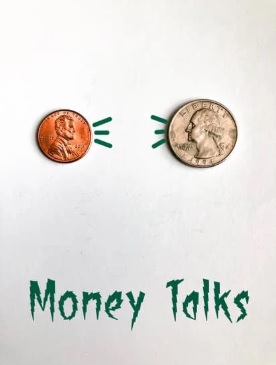

The Secret Language of Business 🗣️💰

✨ From the Editor’s Desk

Numbers are the language of business. The problem? Most entrepreneurs and managers were never taught how to “listen.” This month, we unpack the three main financial statements and how they speak – so you can finally hear what your business is trying to tell you.

📊 Main Feature: The Language of Finance

- Income Statement – The Storyteller

- Shows sales, costs, and profit over a period.

- Think of it as the diary of your business: “This is how much we made, and this is what we spent.”

- Balance Sheet – The Photographer

- A snapshot of what you own(assets) and what you owe (liabilities) at a moment in time.

- It answers: “If we closed the doors today, what would be left?”

- Cash Flow Statement – The Truth Teller

- Tracks actual money moving in and out.

- It exposes whether your “profit” is real or just on paper.

🏪 A Café Owner’s Story

Sarah’s café showed R50,000 profit on her income statement. She celebrated… until she couldn’t pay rent. Why? Most of her customers bought on credit, so the cash never arrived.

Lesson: Profit ≠ Cash. Always check the flow.

🧩 Translate This

“Debtors Days = 60”

Plain English: Customers take 2 months to pay. That’s why your bank account feels like a desert.

🕯️ Final Word

Learning the language of finance isn’t about becoming an accountant. It’s about becoming fluent in the conversations that matter — the ones that drive strategy, growth, and survival.

At Finance Fusion, we make finance simple, practical, and fun – for non-finance professionals.